2 The Wellness Industry

Learning Objectives

In this chapter we will consider the wellness industry at global, regional and national scales.

At the conclusion of this chapter students will be able to:

- Describe the size and growth potential of the global wellness economy

- Discuss the wellness market post pandemic overall as well as by sector and region

- Understand consumer spending in the US wellness market

- Explain criticisms of the wellness market

What is the wellness economy?

The Global Wellness Institute (GWI) describes the wellness economy as, “industries that enable consumers to incorporate wellness activities and lifestyles into their daily lives” (Global Wellness Institute, 2024, p. 2). Specifically, GWI monitors goods and services marketed and sold as “wellness” in the consumer marketplace, and has designated eleven economic subsectors (see Figure 3, below) and six areas of economic activity, namely: (1) North America, (2) Asia Pacific, (3) Europe, (4) Latin America-Caribbean, (5) Middle East-North Africa, and(6) Sub-Saharan Africa, within the global wellness economy (Global Wellness Institute, 2023).

GWI has measured the annual growth and size of the global wellness economy (Global Wellness Institute, 2024). Their figures show that overall growth has remained strong and the outlook promising. In the first published report, GWI estimated that the wellness market generated $3.4 trillion the preceding year. The latest figures from 2023 show that a decade later, the global wellness economy had almost doubled, generating an estimated $6.3 trillion dollars across all sectors (see Figure 3, below) (Global Wellness Institute, 2025). GWI (2025) forecasts that the wellness economy will continue to grow through 2028 at an annual rate of 7.3%, and at which time it is expected to approach $9.0 trillion in total consumer spending.

Figure 3: $6.3 Trillion Wellness Economy in 2023 by Sector (Global Wellness Institute, 2025)

The global Wellness Economy by region

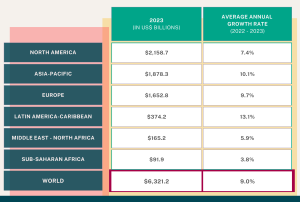

Whilst all geographic regions experienced growth in their wellness economies between 2022 and 2023, the rates varied considerably. Latin America-Caribbean saw the highest growth rate at 13.1%, compared with the Middle East-North Africa and Sub-Sharan Africa which experienced the slowest growth at 5.9% and 3.8% respectively (see Figure 4, below) (Global Wellness Institute, 2025).

North America, Asia-Pacific, and Europe continued to dominate, accounting for 90% of the global wellness economy (see Figure 4, below) (Global Wellness Institute, 2025). Per capita spending on wellness was also notably higher in North America ($5,768) and Europe ($1,794) compared with other regions, reflecting both the higher income levels and more developed wellness economy in these areas (Global Wellness Institute, 2025). At the country level, the five largest wellness markets in 2023 were the United States ($2.0 trillion), China ($870 billion), Germany ($310 billion), Japan ($255 billion), and the United Kingdom ($230 billion) (Global Wellness Institute, 2025).

Figure 4: Wellness Economies by Region (Global Wellness Institute, 2025)

The global Wellness Economy Post-Pandemic

Pre-pandemic, the global wellness economy was characterized by strong and consistent growth overall. In 2019, consumer spending reached $4.9 trillion, with an annual growth rate of 6.6% between 2017 and 2019, outpacing the global economic growth rate of 4.0% over the same period (Global Wellness Economy, 2022).

Whilst the initial shock of the COVID-19 pandemic caused a marked slowdown, the market rebounded as well as brought the concept wellness into sharper focus with consumer interest growing, even as short-term spending declined (Global Wellness Economy, 2024). In addition along with increased awareness of environmental impacts as a result of the pandemic, a wider array of stakeholders began to take greater interest in wellness such as employers, schools, public health initiatives, and urban planning (Global Wellness Institute, 2023).

In 2020 at the height of the pandemic, the wellness economy fell by 8.5% to $4.6 trillion, a contraction three times that of the global GDP which declined by 2.7% (Global Wellness Economy, 2024). In 2021, however, the wellness economy experienced a strong resurgence reaching an impressive growth rate of 17.5% year over year (Global Wellness Economy, 2025). By 2022, and a relatively modest growth rate of 8.1%, notwithstanding, the global wellness market reached $5.6 trillion, 14% larger than its pre-pandemic market size (Global Wellness Economy, 2024).

Per capita spending also demonstrated market resilience pre and post pandemic. Annually, per capita spending on wellness grew by 5.9% between 2019 and 2023, outpacing annual growth in consumer out-of-pocket healthcare spending at 4.1% (Global Wellness Economy, 2025). Wellness spending also surpassed the growth rates of several other sectors, including hotels/restaurants (3.8%), education (1.6%), and clothing/shoes (1.4%), globally and across all regions during that same period (Global Wellness Economy, 2025).

Wellness economies post-pandemic by sector

The impact of the pandemic on the wellness economy varied across sectors. Declines due to COVID-19 were witnessed in seven out of the eleven wellness sectors as identified by GWI (Global Wellness Economy, 2023). The four sectors most negatively impacted were: (1) Wellness Tourism, (2) Thermal/Mineral Springs, (3) Spas, and (4) Workplace Wellness. The Wellness Tourism and Thermal/Mineral Springs sectors were severely curtailed by travel restrictions and border closures, leading to a sharp decline in international travel, whilst business shutdowns and stay-at-home orders impacted domestic trips (Global Wellness Economy, 2023). Such impacts were also experienced by Spas whose virtual offerings could not adequately replace the full immersion, in-person experiences required of that sector’s services (Global Wellness Economy, 2025). Workplace wellness also contracted due to several factors such as a shift to remote work, and business shutdowns and cost-cutting measures (Global Wellness Economy, 2021).

Over the course of the pandemic, four wellness sectors maintained positive growth. These sectors included: (1) Wellness real estate, (2) Public Health, Prevention, & Personalized Medicine, (3) Mental wellness, and (4) Healthy Eating, Nutrition, & Weight Loss (Global Wellness Economy, 2024). Wellness Real Estate maintained the highest growth rate of 21.6%, bolstered by a growing understanding of the critical role that external environments play in physical and mental health, even as overall construction shrank by 3.9%, (Global Wellness Economy, 2024). Public Health, Prevention, & Personalized Medicine saw marked expansion as governments and healthcare systems around the world increased their COVID-19 spending (Global Wellness Economy, 2024). Mental Wellness posted strong growth as consumers sought solutions for stress and isolation (Global Wellness Economy, 2024). The Healthy Eating, Nutrition, & Weight Loss sector grew due to consumers seeking packaged foods, beverages, vitamins and supplements(Global Wellness Economy, 2024).

As of 2023, nine of the eleven wellness sectors had fully recovered from the pandemic, exceeding their 2019 levels (Global Wellness Economy, 2024). The two sectors that had not yet fully recovered were Workplace Wellness, at 99.9% of its 2019 level, and Thermal/Mineral Springs, at 95.4% of its pre-pandemic level (Global Wellness Economy, 2024).

Wellness economies post-pandemic by region

By 2023 all regions had surpassed their 2019 pre-pandemic levels, indicating strong demand across the global wellness economy. North America, Europe, and the Middle East-North Africa demonstrated the strongest resilience and growth; by 2023 North America’s wellness economy reached 137% of its 2019 level, The Middle East-North Africa region reached 130% and Europe reached 125% of its 2019 level. (Global Wellness Institute, 2024).

For the first time following the pandemic the first time, North America also surpassed Asia-Pacific to become the largest regional wellness economy (Global Wellness Institute, 2023). This shift was driven by the relatively slower post-pandemic recovery in China, which favored prolonged restrictions (Global Wellness Institute, 2024). Currency depreciation in several major Asian markets, including Japan, South Korea, and Australia, and weakened economic conditions in China and Japan, further contributed to these shifts in wellness economic recovery (Global Wellness Institute, 2023).

wellness consumer spending in the usa

Research conducted by McKinsey & Company in 2022 provide insights into wellness consumer spending in the United States. By their estimates the market grew to $450 billion with an annual expansion rate of over 5% (Callaghan et al., 2022). This expansion reflected growing interest as 50% of US consumers ranked wellness as a top daily priority compared with 42% in 2020 (Callaghan et al., 2021; Callaghan et al., 2022). Across generational cohorts, Millennials in particular prioritized wellness products and services and are expected to place an even higher priority on wellness in the coming decades (Callaghan et al., 2022). At the time of the survey, 46% of Millennial respondents stated they had purchased fitness products and services, and 42% that they had purchased nutritional products and services, compared with only 28% and 24% respectively across all other age groups (Callaghan et al., 2022). For Millennials, influencers and celebrities played the most significant role in shaping buying habits and purchasing decisions (Callaghan et al., 2022).

Consumer data also revealed a shift towards more diverse and personalized products and services as well as e-commerce spending (Callaghan et al., 2022). Encompassing a more holistic view, both Millennials and Gen Z exhibited strong demand for diverse wellness offerings with these consumers viewing overall physical and mental health, in addition to physical appearance, as integral aspects of wellness (Callaghan et al., 2022).

A preference for digital consumption was also noted, with a rising share of consumer spending attributed to online channels and increased adoption of digital platforms overall was projected to be a lasting trend. (Callaghan et al., 2022). Amongst those for whom digital engagement in wellness apps and online training had become routine, there was growing interest in products and services that catered to multiple wellness dimensions (Callaghan et al., 2022). For example, consumers were increasingly drawn to offerings that combined mindfulness and fitness, or those that bridged nutrition and appearance in a single app (Callaghan et al., 2022). A corresponding preference for offerings tailored to individual needs, including the sharing of personal data over privacy concerns, was reported among 49% of Millennials and 47% of Gen Z (Callaghan et al., 2022).

Finally, along with Brazil a desire to increase mindfulness was of primary interest to US consumers(Callaghan et al., 2022). In the consumer market, this category includes such products and services as mindfulness apps, counseling and therapy, or meditation studios (Callaghan et al., 2022). By comparison, consumers in China and United Kingdom prioritized better nutrition, Germany increased fitness, and Japan better appearance, according to study results(Callaghan et al., 2022).

Criticisms of the Wellness Industry

Although the pursuit of wellness on the individual level would be difficult to denounce as anything other than a worthwhile and even laudable goal, a number of criticisms have been leveled at the wellness industry over the years, which are worth noting here.

Pseudoscientific Claims and Misleading Marketing

A primary criticism is that the wellness industry’s relies upon pseudo-scientific claims and anecdotal evidence to push products, supplements and cure-alls. Registered dietitians, for example, point to the spread of misinformation regarding concepts like “adrenal fatigue,” “chronic candida,” and “leaky gut” which lack scientific evidence. Marketers have been criticized for playing on societal anxieties and fueling unrealistic expectations, hawking products such as jade eggs for sexual vitality or bone broth to combat COVID-19. Solutions to complex health problems, critics argue, require rigorous studies and clinical evidence beyond the scope of wellness gurus and the commercial market.

Consumerism

Lack of Diversity and Inclusivity

The wellness industry has been criticized for its lack of diversity and inclusivity. A marker of social status due to its emphasis on the consumption of high-end and often prohibitively expensive products, services and experiences, the wellness industry is accused of promoting a white-centric, elitist view. Such socioeconomic barriers limit access to wellness practices and resources for marginalized communities, exacerbating existing health disparities. Critics emphasize the need for the industry to become more accessible and inclusive for all, regardless of race, ethnicity, socioeconomic status, or body size.

Perpetuation of Unrealistic Beauty and Wellness Standards and Individual Insecurities

Critics argue that the wellness industry, instead of promoting holistic well-being, often perpetuates unrealistic beauty and wellness standards, primarily targeting women. The conflation of wellness with physical appearance, particularly thinness, can trigger body image issues, disordered eating, and mental health problems. Social media, flooded with images of seemingly perfect lifestyles, exacerbates this by fueling constant comparisons. For instance, individuals might feel pressured to emulate the “perfect” organic lunches they see other parents packing or the latest workout routines their coworkers adopt, leading to feelings of guilt or inadequacy.

Which knowledge, skills, and abilities are supported by this chapter?

Review Questions

- Why is it important to identify the 11 sub- sectors when analyzing the economic impact of the wellness industry as a whole?

- In what ways did the COVID-19 pandemic reshape consumer demand and investment across different wellness sectors and regions?

- How do regional disparities in per capita wellness spending reflect broader economic and cultural differences in health and lifestyle priorities?

- What role do Millennials and Gen Z play in shaping the future of the wellness economy, particularly in relation to personalization and digital engagement?

- How can increased awareness of criticisms—such as pseudoscience, exclusivity, and unrealistic standards—help improve the credibility and inclusivity of the wellness industry?

References

Barrell, S. (2023, July 28). The rise of wellness travel, from rewilding to yoga and pilgrimages. National Geographic. https://www.nationalgeographic.com/travel/article/wellness-travel-rewilding-yoga-pilgrimages

Callaghan, S., Lösch, M., Pione, A., & Teichner, W. (2021, April 8). Feeling good: The future of the $1.5 trillion wellness market. McKinsey & Company. Retrieved from https://www.mckinsey.com/industries/consumer-packaged-goods/our-insights/feeling-good-the-future-of-the-1-5-trillion-wellness-market

Callaghan, S., Lösch, M., Medalsy, J., Pione, A., & Teichner, W. (2022, September 19). Still feeling good: The US wellness market continues to boom. McKinsey & Company. Retrieved from https://www.mckinsey.com/industries/consumer-packaged-goods/our-insights/still-feeling-good-the-us-wellness-market-continues-to-boom

Global Wellness Institute (2021, December). The Global Wellness Economy: Looking Beyond COVID. https://globalwellnessinstitute.org/wp-content/uploads/2021/11/GWI-WE-Monitor-2021_final-digital.pdf

Global Wellness Institute. (2023, November). Global Wellness Economy Monitor 2023. Data for 2019-2022. https://globalwellnessinstitute.org/industry-research/2023-global-wellness-economy-monitor/

Global Wellness Institute. (2024, January). The Global Wellness Economy: Country Rankings. https://globalwellnessinstitute.org/industry-research/2024-the-global-wellness-economy-country-rankings/

Global Wellness Institute. (2025, January). The Global Wellness Economy: Country Rankings (2019-2023). https://globalwellnessinstitute.org/industry-research/2025-the-global-wellness-economy-country-rankings/

Guarneri, M. (2019, October 1). The Integrative Health and Medicine Movement: A historical and personal perspective. PubMed Central (PMC). Retrieved from https://www.ncbi.nlm.nih.gov/pmc/articles/PMC7219444/